Negative Interest Rates – How Will They Impact You?

With interest rates at record lows, savers are getting a measly return on their money, especially after factoring in inflation. Then, there is even talk of a possibility of negative interest rates. Negative interest rates sound counter-intuitive, but they are a strategy by central banks actioned in a weak economy to kick-start financial activity. Several countries in Europe as well as Japan have introduced negative interest rates so to think that it will never happen in Australia is a bit short sighted. Ultra-low or even negative interest rates hurt all investors, but retirees are the worst off. In this scenario, very low or negative returns are expected and the elderly don’t have time for their investments to ‘bounce back’ up.

Life expectancy is on the rise. According to the World Health Organisation “The average Australian born last year will live into their 80s, surviving longer than most of the world,” but with the age pension being one of the costliest items in the Australian federal budget and an outdated superannuation system, retiring will not be easy for many. And for some, retirement is not even an option.

If you’re wondering if investing for income is the right strategy, Buyer Solutions past investor clients can tell you that it can be if you follow our advice and buy smart.

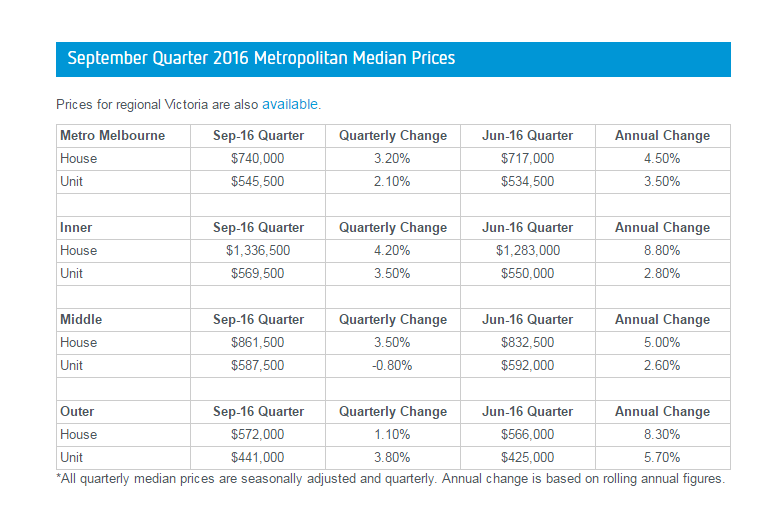

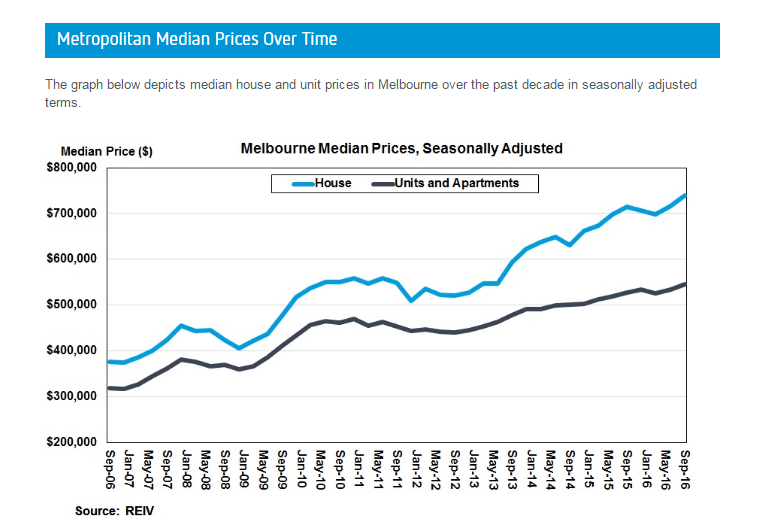

Full-rate home owners have nine times the net worth of non-home owners, (more here) so investing in property as part of a retirement fund can be a lucrative way to pad out the government pension. Property prices are growing overall and show no sign of slowing down. If you buy selectively on the basis of Buyer Solutions strict asset selection criteria, you can even outperform the median data.

Source: REIV

One example we can give you is the purchase a property in Footscray in late April this year. It was on a full block of land and was in neat, lettable order, but would benefit from an update in futures. A house on a truncated block of land down the same street sold last weekend at auction for $869,000. So our clients have made at least $50,000 to $70,000 equity in their investment property in just six months. They are thankful for our advice and guidance and will certainly benefit come retirement.

Last night on three main news broadcasts on Australian television, reporters flagged the possibility of interest rates dropping in November or December and inflation being below where the Reserve Bank and Australian Government wanting it to be.

So, with negative interest rates a looming possibility in Australia, any one able to constructively invest for income over and above bank interest rates and/or for strong capital growth, should be actioning their plans and “getting into the market”. Delays could really cost you at retirement age and you don’t want to risk being on the aged pension exclusively when you retire.

What about First Home Buyers?

For First Home Buyers negative interest rates sound great but they could be a disaster. If you have no deposit, then saving for that deposit will be even harder. What inducement do you have to put money in the bank for no return and even have to pay a fee for the bank to hold your money? Tough times may be getting tougher for our First Home Buyers. So if you are spending up big on your lifestyle now and think you can save for a home later, think again.

Our advice as professional property buyers is to book your consultation now with a good financial advisor and Buyer Solutions and start working on those property buying plans as soon as possible. Whether you are investing of home buying, there may be “no time like the present”.

Buyers Agent, Buying property, Home buying, Housing Affordability, Housing Market, Investment, Investment property, State of the market

+61 39816 8555

+61 39816 8555